Third trimester update! Here’s my light-hearted take on being pregnant in the last trimester. I got pregnant at 31 with PCOS. I delivered two months after my 32nd birthday- and I’m still salty I couldn’t have a drink. LOL real girl talk here!

Third trimester update! Here’s my light-hearted take on being pregnant in the last trimester. I got pregnant at 31 with PCOS. I delivered two months after my 32nd birthday- and I’m still salty I couldn’t have a drink. LOL real girl talk here!

I guess the best place to start is where we left off. I was in a great relationship, posting outfit ideas, and blogging about how to dress my athletic endo-mesomorph body. I had my year completely planned out. Everything I wanted to do with this blog, my Youtube channel, and my acting career.

I was ready. Then something even more exciting happened – I got engaged! My husband and I immediately began planning our elopement.

Cyber Monday is here once again, so it’s time to stock up on styles that look great on your athletic body. Most female muscular body types are broad in the shoulders, and narrow in the hips. This creates a kind of “inverted triangle” shape. The less amount of hip you have, the more important it is to find bottoms that create fullness along the pevlis.

Eating anything under 300 calories during Thanksgiving, that isn’t plain lettuce, seems impossible. Especially at holiday gatherings where taste, not health, seems to win the day. That’s why I’ve put together two healthy snacks under 300 calories that are perfect to bring to parties. They are meatless, affordable, healthy, and easy to make. Between these two dishes, there is something for everyone to enjoy.

The Holidays are upon us and credit cards are lit. Yes, LIT. This is the most expensive time of the year, and our bank accounts deplete with every check mark on the “nice list.” Yes, being generous has a cost and retailers love a generous heart. It seems we have two choices, give big and go broke, or scrooge it up and keep our coins.

If you don’t have the heart to do the latter, the question becomes, how can one give without going broke in the process? Here are a few very practical and easy tips and tools to help you keep your heart and your wallet in check.

I am living proof that you can pay off a large amount of debt in short period of time without winning the lottery or being born into a wealthy family. Truth be told, it isn’t rocket science, it just takes laser focus intention, a well constructed habit loop, a little know-how, and a strong desire to be debt free. The five key tips for getting out of debt are Mentality, Income, Budget, Automate, and Mentors. In the video below I go into detail about each word and share a bit about my journey to debt freedom in the process.

Growing up, money wasn’t exactly a positive topic of discussion. I heard many sayings like “Money is the Root of all Evil”, which eventually turned to “LOVE of money is the Root of all Evil. Also sayings like, “Don’t count the money in my pocket” whenever I wanted my mother to buy something that seemed easy to purchase. There were also notions that the wealthy somehow weren’t as noble or God fearing because they had money. Not all of these ideas came from home, many came from hearsay on television and in politics. In contrast, I witnessed the wealthy give openly to the public as well as to my family. Needless to say, not only was I very confused about money, I believed my life would probably always be one of poverty.

I’ve racked up debt like many other people I know, and almost none of it was “irresponsible” spending. Things like, student loan debt, a car loan, credit card debt from an emergency purchase of a laptop, and basic living expenses from my move to Los Angeles. I could go more in depth, but you get the picture, I was “normal”.

I’ve always been intrigued by the world of personal finance and have since dedicated the last two years to reading as much as I could on the topic. It wasn’t until three months ago that I got on a true real-numbers based budget and began to attack my debt using Dave Ramsey’s, Debt Snowball method. My advice for getting started is to assess your situation, then take action.

1. Get your Credit Score and look at your Credit Report to see where you stand with the government and how you look to lenders during a credit analysis.

2. Pull out your bank statements and write down (in exact numbers) how much debt you owe. Numbers don’t lie and sometimes we have to get face to face with the truth before we can make an effective plan.

3. Get yourself on a BUDGET! None of this working with estimates stuff. What are your REAL numbers? What is your exact dollar amount of income and what bills and expenses do you have? Create a budget at the top of every month so that you can direct your dollars where to go. Why every month? Because expenses and income fluctuate. Cash gifts happen, doctors appointments get planned, and major life events happen that can change everything. Being prepared ahead of time, keeps you responsible and out of debt.

4. Quickly save $1,000 cash for emergencies. Stuff happens, I know. That’s how I ended up in debt. This eliminates the urge to charge a credit card or take out a loan for an emergency. For example, if you get in a car accident, most car insurance deductibles aren’t above $1,000. With the money saved, you can pay off the debt without charging a credit card. If your fund gets depleted, build it up again.

5. List your debts from smallest to largest and start paying off your debt one by one. Begin with the minimum payments on all of them and use excess money to pay down the smallest debt. When that debt is paid, take the minimum payment and the excess income and apply it to the next debt. This creates the debt snowball affect.

5b. List your debts from the highest interest rate to the lowest, and pay your debt down that way. This one makes financial sense, but may be harder psychologically because your highest interest rate may be your largest debt. Therefore, it may be easy to lose steam because of the time it takes to build momentum.

6. Keep at it. Don’t give up! I’m currently on Dave Ramsey’s Baby Step Two and paying off my debt. It’s challenging, but I keep myself motivated with books, seminars, and podcasts. I’ll leave my favorite motivators below this video.

My first personal finance blog post! I hope my advice and suggestions help start you on your road to financial freedom. Happy debt destroying!

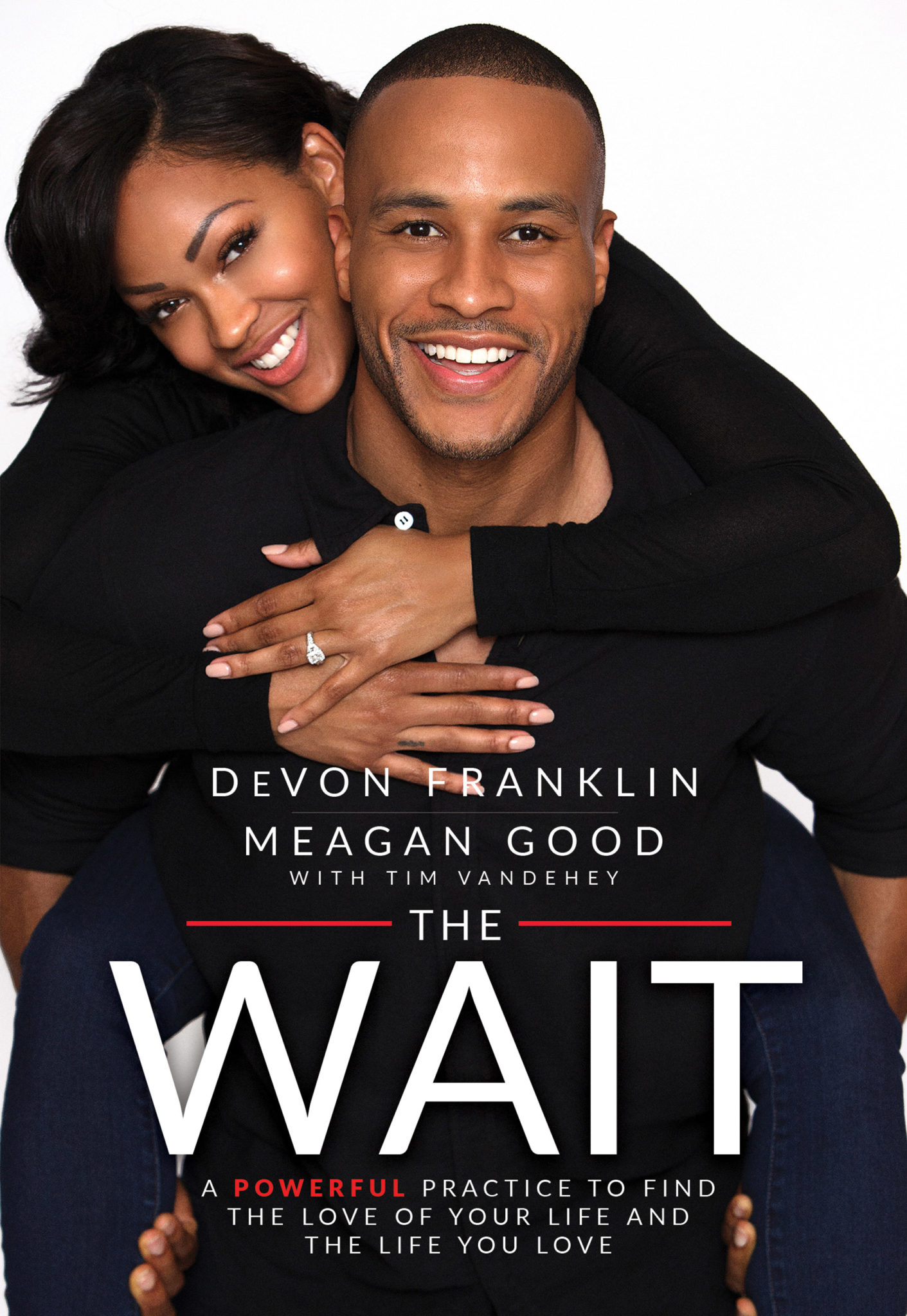

I recently had the pleasure of attending a book signing for The Wait. It tells the story of Devon Franklin and Meagan Good’s journey to finding love (and each other) by putting God first and choosing to be celibate before marriage. Here are some clips that give a sneak peak into their story.

I’ve began reading their book and I love the approach they have taken. It offers insight on why they chose to wait as well as guidance for those who are attempting to find love and are tired of hitting the same road blocks. Whether you are thinking of becoming celibate, are already waiting, or want some insight on a different approach, I think it’s worth reading.

To learn more about the book visit their website, here.

Okay, let’s face it. That run down button-down shirt with the “small” stain and the button missing at the bottom, has got to go! Oh, and just because it was your favorite pair of overalls in the 9th grade doesn’t mean you have to hold onto it.

There comes a time when we all need a little wardrobe upgrading in our lives. With so many clothes staring back at us in our closets, which ones do we keep and which ones get tossed?